[Nov 2020] The latest update Microsoft MB-310 dumps and online practice tests from Leads4Pass

The latest Microsoft MB-310 dumps by leads4pass helps you pass the MB-310 exam for the first time! leads4pass Latest Update Microsoft MB-310 VCE Dump and MB-310 PDF Dumps, leads4pass MB-310 Exam Questions Updated, Answers corrected! Get the latest LeadPass MB-310 dumps with Vce and PDF: https://www.leads4pass.com/mb-310.html (Q&As: 144 dumps)

[Free MB-310 PDF] Microsoft MB-310 Dumps PDF can be collected on Google Drive shared by leads4pass:

https://drive.google.com/file/d/1FjJZ6JKfj2GyFTAaMVyfibMWhP0IAQr6/

[leads4pass MB-310 Youtube] Microsoft MB-310 Dumps can be viewed on Youtube shared by leads4pass

Microsoft MB-310 Online Exam Practice Questions

QUESTION 1

A client is implementing Accounts payable. The client wants to establish three-way matching for 100 of their 5,000

stocked items from a specific vendor.

The client requires the ability to have items that require only two-way matching and specific items that require three-way

matching.

You need to configure the system in the most efficient manner to achieve these requirements.

What should you do?

A. Configure a company matching policy of a three-way match

B. Configure a company matching policy of non-required and specify the items that require a three-way match

C. Configure a company matching policy of two-way matching and set the matching policy for specific item and vendor

combination level to three-way matching

D. Configure a company matching policy of two-way matching and specify the items that require a three-way match

E. Configure a company matching policy of two-way matching and specify the vendors that require a three-way match

Correct Answer: C

Reference: https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/accounts-payable/tasks/set-upaccounts-payable-invoice-matching-validation

QUESTION 2

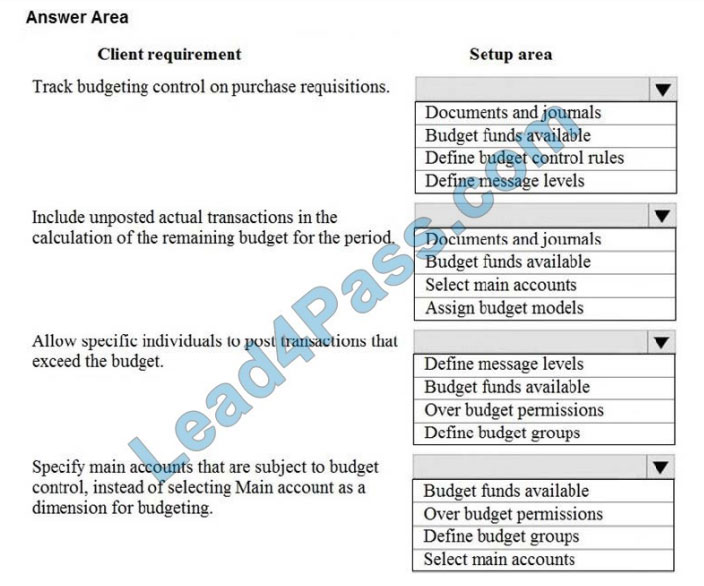

HOTSPOT

A client is implementing the Budgeting module in Dynamics 365 Finance.

You need to configure the correct budget control area to meet the client\\’s requirements.

1.

Track budgeting control on purchase requisitions.

2.

Include unposted actual transactions in the calculation of the remaining budget for the period.

3.

Allow specific individuals to post transactions that exceed the budget.

4.

Specify main accounts that are subject to budget control, instead of selecting the Main account as a dimension for

budgeting.

What should you configure? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Correct Answer:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/budgeting/budget-control-overview-configuration

QUESTION 3

A company plans to create a new allocation rule for electric utility expenses.

The allocation rule must meet the following requirements:

Distribute overhead utility expenses to each department.

Define how and in what proportion the source amounts must be distributed on various destination lines.

You need to configure the allocation rule.

Which allocation method should you use?

A. Distribute the source document amount equally

B. Fixed weight

C. Equally

D. Basis

Correct Answer: D

Reference: https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/general-ledger/ledger-allocationrules

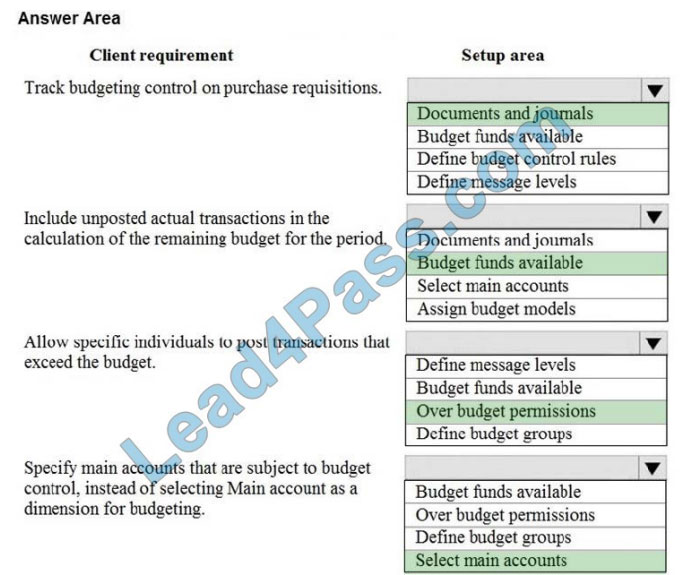

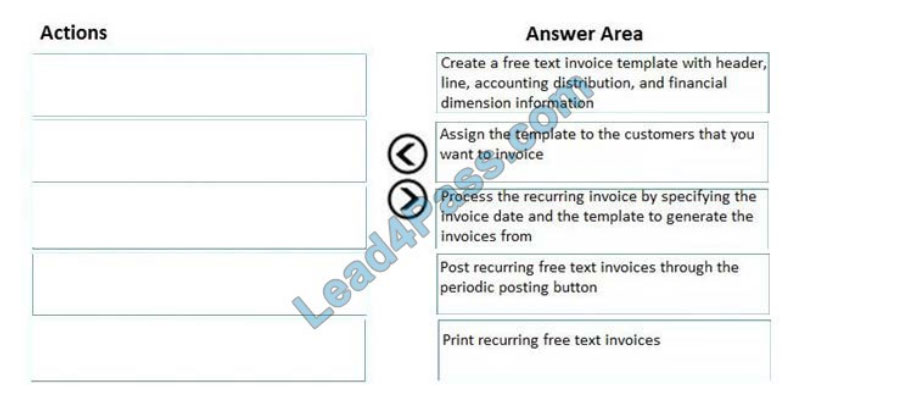

QUESTION 4

DRAG DROP

An organization sells monthly service subscriptions. The organization sends invoices to customers on the 15th of every

month in the amount of $450.00.

You need to set up, configure, and process recurring free text invoices for the customers.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area

and arrange them in the correct order.

Select and Place:

Correct Answer:

QUESTION 5

You need to adjust the sales tax configuration to resolve the issue for User3. What should you do?

A. Create multiple settlement periods and assign them to the US tax vendor.

B. Create multiple sales tax remittance vendors and assign them to the settlement period.

C. Run the payment proposal to generate sales tax liability payments.

D. Create a state-specific settlement period and assign the US tax vendor to the settlement period.

Correct Answer: D

QUESTION 6

A customer uses the sales tax functionality in Dynamics 365 Finance.

The customer reports that when a sales order is created, sales tax does not calculate on the line.

You need to determine why sales tax is not calculated.

What are two possible reasons? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

A. The sales tax group is populated on the line, but the item sales tax group is missing.

B. The sales tax settlement account is not configured correctly.

C. The sales tax authority is not set up for the correct jurisdiction.

D. The sales tax code and item sales tax code is selected, but the sales tax group is not associated with both codes.

E. The sales tax group and item sales tax group are selected, but the sales tax code is not associated with both groups.

Correct Answer: AE

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/indirect-taxes-overview

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/tasks/set-up-sales-tax-groups-item-sales-taxgroups

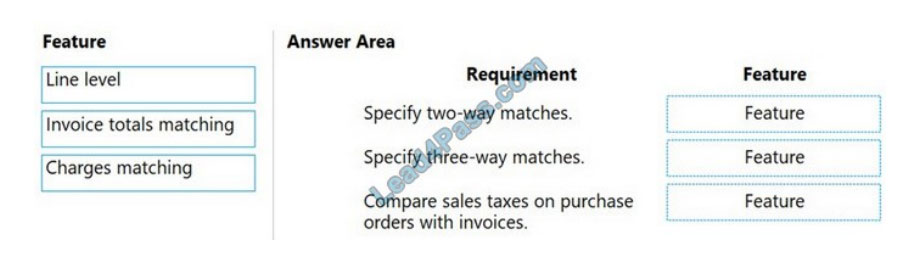

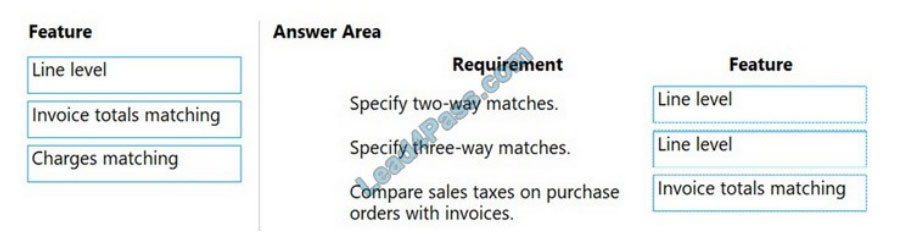

QUESTION 7

DRAG DROP

A customer plans to implement invoice validation policies.

You need to recommend the features needed to meet each of the customer\\’s requirements.

What should you recommend? To answer, drag the appropriate features to the correct requirements. Each feature may

be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view

content.

NOTE: Each correct selection is worth one point.

Select and Place:

Correct Answer:

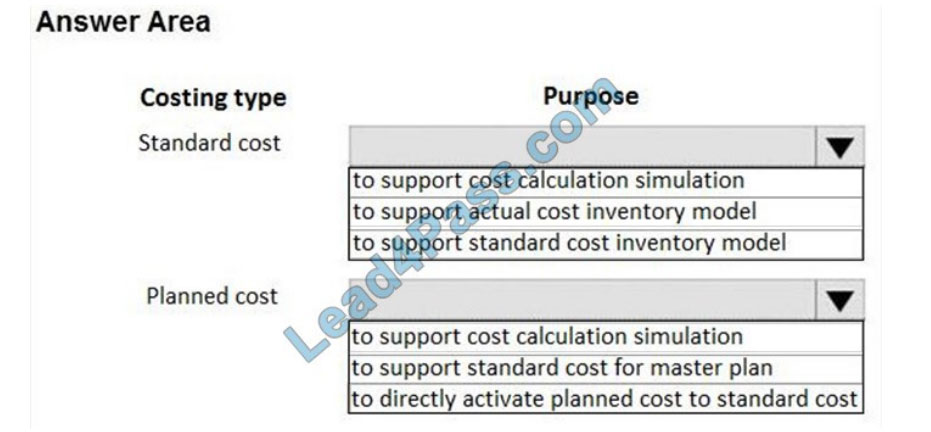

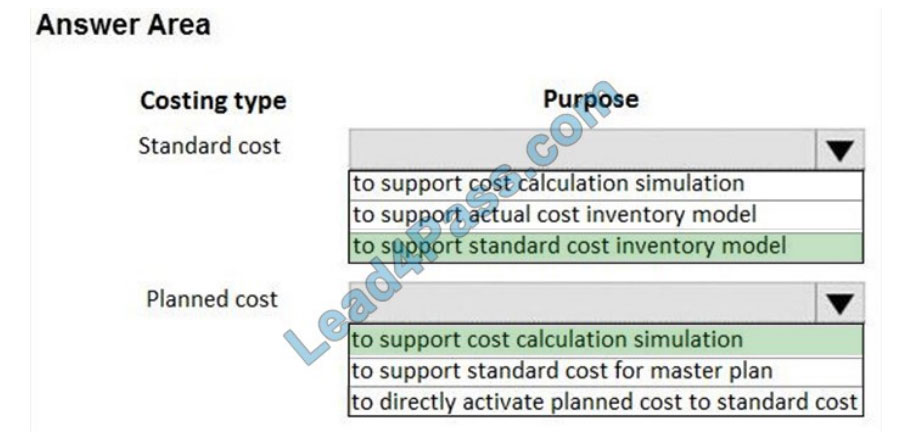

QUESTION 8

HOTSPOT

A food manufacturer uses commodities such as beans, corn, and chili peppers as raw materials. The prices of the

commodities fluctuate frequently. The manufacturer wants to use cost versions to simulate these fluctuations.

You need to set up cost versions and prices to accomplish the manufacturer\\’s goal.

For which purpose should you use each costing type? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Correct Answer:

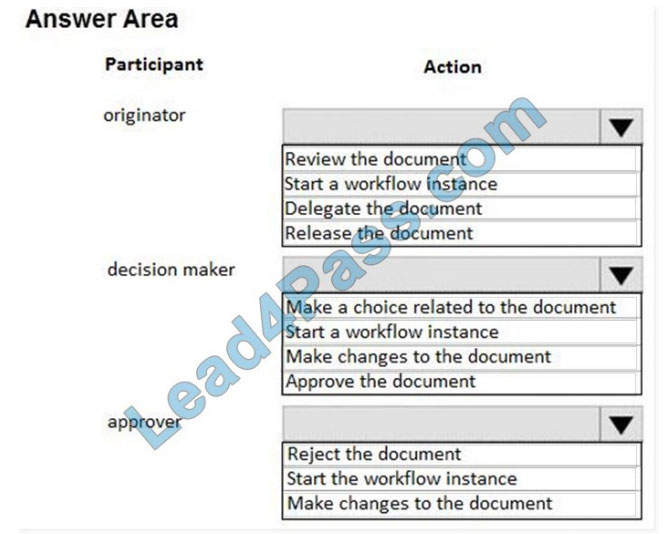

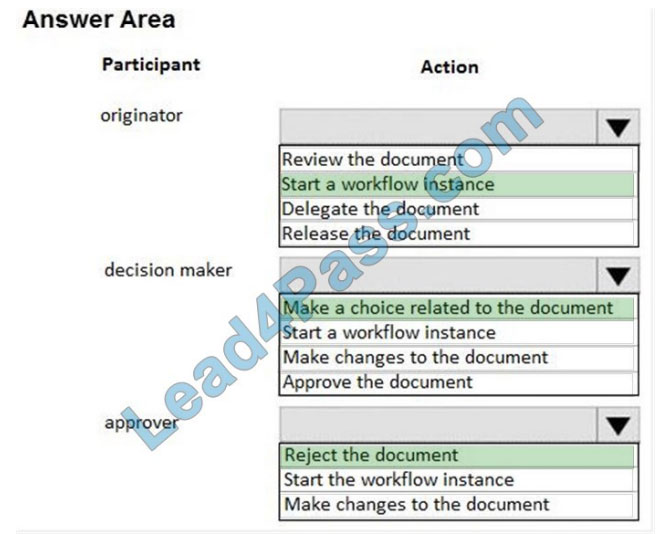

QUESTION 9

HOTSPOT

You are setting up the process for an expense report approval in Dynamics 365 Finance.

You need to assign permission for each participant in the workflow approval process to perform their tasks.

Which action can each participant perform? To answer, select the appropriate option in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Correct Answer:

QUESTION 10

You work for a company that receives invoices in foreign currencies.

You need to configure the currency exchange rate providers and exchange rate types.

What should you do?

A. Configure exchange rate provider, create exchange rate type, and import the currency exchange rates.

B. Select the appropriate HTML key values from the available exchange rate providers. Then, use the provider for

importing one currency exchange rate type.

C. Use a developer to write the HTML key values code to configure the currency exchange rate providers. Then, use the

provider for importing a currency exchange rate type.

D. Use a developer to write the XML key values code to configure the currency exchange rate providers. Then, use the

provider for importing a currency exchange rate type.

Correct Answer: A

References: https://community.dynamics.com/365/financeandoperations/b/365operationsbysandeepchaudhury/posts/configure-currency-exchange-rate-providers-and-import-exchange-rates-automatically-in-dynamics-365-for-finance-andoperations

QUESTION 11

A client has multiple legal entities set up in Dynamics 365 Finance. All companies and data reside in Dynamics 365

Finance.

The client currently uses a separate reporting tool to perform their financial consolidation and eliminations. They want to

use Dynamics 365 Finance instead.

You need to configure the system and correctly perform eliminations.

Solution: Set up Elimination rules in the system. Then, run an elimination proposal. Configure the rules to post to any

company that has Used for financial elimination process selected in the legal entity setup.

Does the solution meet the goal?

A. Yes

B. No

Correct Answer: A

References: https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/budgeting/consolidationelimination-overview

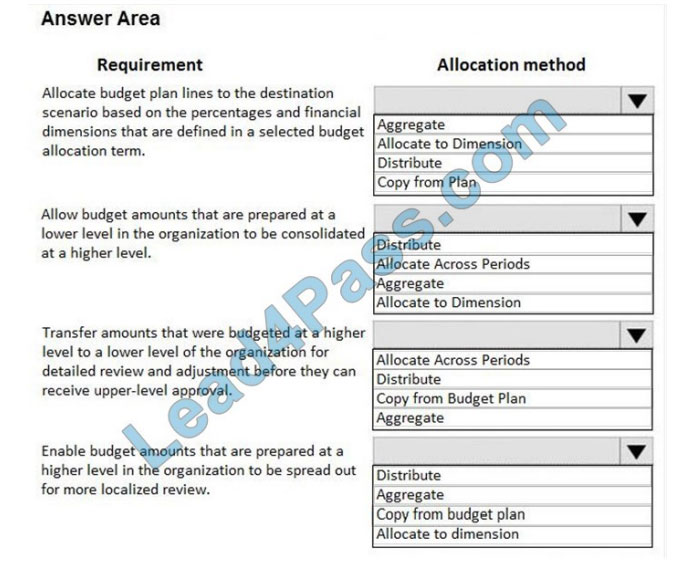

QUESTION 12

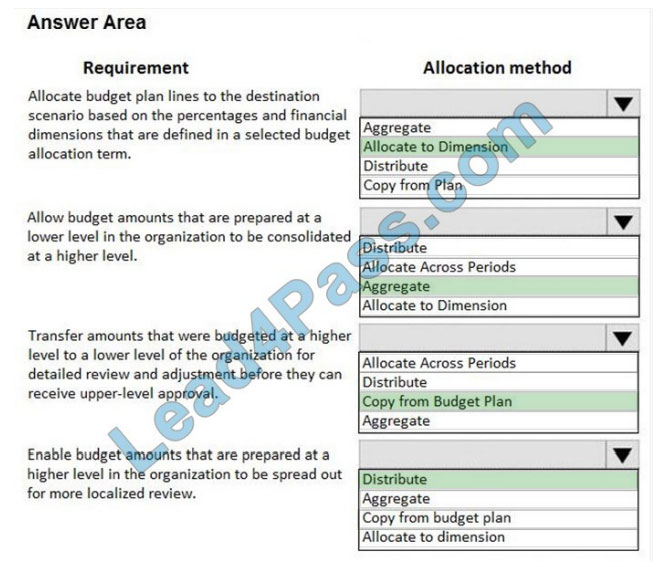

HOTSPOT

You are setting up a budget plan to accurately portray the projected budget for a company.

You need to select the appropriate allocation method for data distribution.

Which allocation methods should you use? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Correct Answer:

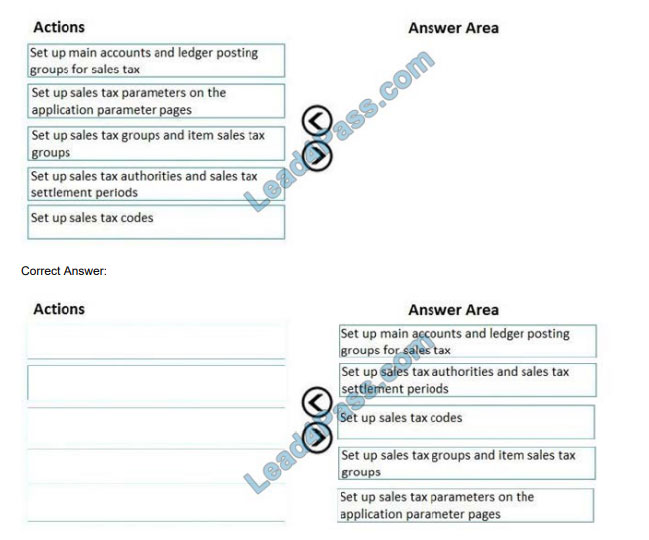

QUESTION 13

DRAG DROP

A retail company has outlets in multiple locations. Taxes vary depending on the location.

You need to configure the various components of the tax framework.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area

and arrange them in the correct order.

Select and Place:

latest updated Microsoft MB-310 exam questions from the leads4pass MB-310 dumps! 100% pass the MB-310 exam! Download leads4pass MB-310 VCE and PDF dumps: https://www.leads4pass.com/mb-310.html (Q&As: 144 dumps)

Get free Microsoft MB-310 dumps PDF online: https://drive.google.com/file/d/1FjJZ6JKfj2GyFTAaMVyfibMWhP0IAQr6/